Southland Industries Adds in Garden Grove

/by Denisse

Real Estate: Contractor takes Money Mailer’s old headquarters

By Mark Mueller | October 16, 2017

Southland Industries, one of the country’s largest mechanical, electrical, and plumbing systems contractors, is stepping up its presence in its home of Garden Grove.

The privately held company, which has a long history in Orange County, signed a lease this month to occupy all of a recently upgraded, 207,953square-foot industrial and office building at 12131 Western Ave.

It’s one of the largest leases in North OC this year, and takes one of the biggest empty buildings in the region off the market.

The 9.6-acre property is a few blocks north of the Garden Grove (22) Freeway near the intersection of Western and Chapman avenues. It previously held the headquarters of Money Mailer LLC, which vacated it a few years ago after downsizing operations.

The building’s current owner, Rexford Industrial Realty Inc. in Los Angeles, has overseen a large renovation of the site since buying it last year from Newport Beach based CT Realty Investors as part of a larger portfolio deal.

Upgrades include creative-office flourishes to the nearly 50,000 square feet of office space, plus a new facade and an enlarged parking lot.

Southland Industries is scheduled to move into the building around December under a 10-year lease, according to Clyde Stauff, senior executive vice president for the Irvine office of Colliers International.

Stauff represented Rexford in the lease along with Colliers Executive Vice President Michael Hartel and Voit Real Estate Senior Vice President Mike Bouma.

Keeping the company in the city is “a big win for Orange County,” Stauff said.

Mike Wiley, corporate managing director at the Newport Beach office of tenant brokerage Savills Studley, represented Southland Industries in the lease.

The property was being marketed for 76 cents per square foot, per month, according to Voit’s marketing material.

Tofu Takeover

The new lease is a step up in space for Southland Industries, whose current local offices in Garden Grove, about a mile from the Western Avenue property, total about 120,000 square feet.

The company provides mechanical engineering and other services for large construction projects, hospitals and universities being among other clients. It employs about 500 people in OC and did nearly $400 million in sales here last year, per Business Journal data, No. 47 on the largest private companies list.

Notable projects it’s working on include the new soccer stadium for the Los Angeles Football Club in downtown Los Angeles, according to Southern California Division Leader Payman Farrokhyar.

The Western Avenue facility, featuring new equipment, will offer the company a “forward-looking” space for its design-build facilities, with plenty of room for interdepartmental collaboration, and allow for more growth, Farrokhyar said.

“We’ve been aggressively hiring” recently to support the company’s Southern California operations, he said. “This market has been doing really well.”

The company’s also nearing a lease for a new retail location in downtown L.A.

The Business Journal reported in August that House Foods America Corp., a Garden Grove-based manufacturer of tofu, noodles and other Asian-influenced food products, bought a building in the city that Southland Industries had occupied, an 83,000-squarefoot office at 7421 Orangewood Ave.

House Foods paid about $17.5 million for the property, which sits next to its headquarters and local tofu manufacturing facilities, with plans to expand area operations.

Southland had leased the building on Orangewood, but it owns another, smaller office nearby at 7390 Lincoln Way.

The company lists its headquarters as being at the Lincoln Way building, and it has much of its corporate operations in Garden Grove, although some of its executive team is based in the Washington, D.C., suburbs.

It moved its Southern California operations and headquarters from Irvine in 2012.

The Western Avenue facility will be the Southern California division of Southland, while corporate offices will remain at the Lincoln Way building, according to Savills Studley’s Wiley.

The company had been looking at facilities outside of the area for a potential move, including sites in the Inland Empire, before inking a deal to stay in Garden Grove, he said.

“Their preference had been to stay in North Orange County.”

Rexford Industrial Announces Completion Of 317,000 SF Of Value-Add Repositioning And Lease-Up Plus 40,473 SF Of Acquisitions

/by DenisseLOS ANGELES, Oct. 12, 2017 /PRNewswire/ — Rexford Industrial Realty, Inc. (the “Company” or “Rexford Industrial”) (NYSE: REXR), a real estate investment trust focused on owning and operating industrial properties located in Southern California infill markets, today announced the completion of value-add repositioning and lease-up at two properties, 3880 W. Valley Boulevard and 12131 Western Avenue. Additionally, the Company acquired two industrial properties for $7.4 million. The acquisitions were funded using cash on hand.

“We are pleased to announce the lease-up and completion of value add repositioning of approximately 317,000 square feet, as we continue to leverage Rexford’s ability to create value through repositioning as we capitalize on the unique supply-demand dynamics of the infill Southern California industrial market,” stated Howard Schwimmer and Michael Frankel, Co-Chief Executive Officers of the Company. “These two projects achieved attractive, above-market stabilized yields and are a testament to the quality and hard work of the Rexford team. In addition, Rexford recently closed $7.4 million of incremental acquisition activity, which brought our year-to-date total investments to over $534 million. We continue to see favorable opportunities to execute our internal and external growth strategies to drive cash flow and shareholder value.”

The Company recently completed repositioning and lease-up of 3880 W. Valley Boulevard, located in Pomona in the San Gabriel Valley submarket, a single-tenant 108,500 square foot free-standing building with excess land for container storage. After the previous tenant vacated, Rexford completed extensive renovations including a new building façade, renovation of office areas, 19 new dock-high loading positions and ESFR fire sprinklers. In August 2017, the Company signed a five-year triple net lease to a luxury high-end car company which commenced in September 2017. Rexford achieved a 6.9% unlevered cash yield on total investment based upon the income from the initial year of the lease, which also comprises annual rental rate increases throughout the term of the lease. The tenant was represented by Douglas Sharpe with NAI Capital, and Rexford was represented by Robin Dodson, Erik Larson, and Christopher Tolles with Cushman & Wakefield.

Additionally, Rexford completed repositioning and lease-up of 12131 Western Avenue in Garden Grove in the Orange County submarket, a single-tenant free standing cross-dock building containing 207,953 square feet. After the previous tenant vacated, Rexford completed a full building renovation including a new two-story lobby, modernization of office areas and new ESFR fire sprinklers. In October, the Company signed a 10-year triple net lease with Southland Industries, a national engineering firm, which is expected to commence at year end. Rexford achieved a 5.9% unlevered cash yield on total investment based upon the income from the initial year of the lease, which comprises 3% annual rental rate increases through the term of the lease. The tenant was represented by Matt Wiley of Savills Studley, and Rexford was represented by Clyde Stauff and Michael Hartel with Colliers and Mike Bouma with Voit Real Estate Services.

In September, in an off-market transaction, the Company acquired 1825 S. Soto Street, located in the Los Angeles – Central submarket for $3.5 million, or approximately $139 per square foot. The property consists of 25,040 square feet on 1.03 acres and is fully leased at substantially below market rates to a publicly traded company. The building has 26′ clear heights and a secured yard. According to CBRE, the vacancy rate in the 286 million square foot Central Los Angeles submarket was 1.6% at the end of the third quarter 2017.

In September, Rexford also acquired 19402 S. Susana Road in Rancho Dominguez, located in the Los Angeles – South Bay submarket for $3.9 million, or approximately $255 per square foot. The 15,433 square foot industrial building is situated with excess paved land on 1.69 acres and is fully leased to one tenant. According to CBRE, the vacancy rate in the 221 million square foot South Bay submarket was 0.8% at the end of the third quarter 2017.

About Rexford Industrial

Rexford Industrial is a real estate investment trust focused on owning and operating industrial properties in Southern California infill markets. The Company owns 146 properties with approximately 18.0 million rentable square feet and manages an additional 19 properties with approximately 1.2 million rentable square feet.

For additional information, visit www.rexfordindustrial.com.

Contact:

Investor Relations:

Stephen Swett

424 256 2153 ext. 401

[email protected]

SOURCE Rexford Industrial Realty, Inc.

Related Links

https://www.rexfordindustrial.com

VOIT REAL ESTATE SERVICES DIRECTS THE $7,125,000 SALE OF A 40,840 SQUARE-FOOT INDUSTRIAL PROPERTY IN GARDEN GROVE

/by Denisse

Garden Grove, CA., (September 14, 2017) – Mike Bouma, Senior Vice President, and Eric Smith, Senior Associate, of Voit Real Estate Services’ Anaheim office successfully directed the $7,125,000 million sale of a 40,840 square-foot industrial facility in Garden Grove, on behalf of the seller, The Realty Associates Fund X, L.P., based out of Boston, MA. The buyer, Exelon Realty LLC, a privately owned real estate company based out of Encino, CA, was also represented by Mike Bouma and Eric Smith of Voit Real Estate Services.

“Strong market fundamentals in the Orange County Industrial market, a credit tenant, an excellent Garden Grove location and a long tenancy of similar uses made this property very attractive,” according to Bouma.

The property is located at 7142 Chapman Avenue and 12031/51 Industry Street in Garden Grove.

About Voit Real Estate Services

Voit Real Estate Services is a privately held, broker owned Southern California commercial real estate firm that provides strategic property solutions tailored to clients’ needs. Throughout its 45+ year history, the firm has developed, managed and acquired more than 64 million square feet, managed $1.4 billion in construction projects and completed in excess of $46.5 billion in brokerage transactions encompassing more than 44,500 brokerage deals. Voit’s unmatched expertise in Southern California brokerage, investment advisory, financial analysis, and market research enable the firm to provide clients with forward looking strategies that create value for a wide range of assets and portfolios. Further information is available at www.voitco.com.

VOIT REAL ESTATE SERVICES REPRESENTS WOODWIND COMMERCE PARK, LLC IN THE 20,941 SQUARE-FOOT INDUSTRIAL LEASE IN HUNTINGTON BEACH, CA

/by Denisse

Huntington Beach, CA (September 14, 2016) – Voit Real Estate Services, a leading full-service commercial real estate provider serving the Southwestern U.S. market, is pleased to announce the completion of a 20,941 square-foot industrial lease on behalf of Woodwind Commerce Park, LLC at 7612 Woodwind Drive, Huntington Beach, CA. Mike Bouma and Eric Smith with Voit Real Estate Services represented Lessor, and Louis Tomaselli with Jones Lang LaSalle represented Lessee in this transaction.

“We are pleased to strike a deal that benefits both parties; the landlord with a long term national credit tenant that is a leader within their industry and the tenant with a desirable location for which they can continue to grow this segment of business and better serve their employees,” according to Bouma. “This deal represents the strength of the market with multiple parties competing for this Huntington Beach location.”

Nordson Corporation, an Ohio Corporation will occupy the 20,941 square-foot industrial building, which is owned by Woodwind Commerce Park, LLC. Nordson Corporation signed a 10-year lease and will move to the premises in September 2016.

About Voit Real Estate Services

Voit Real Estate Services is a privately held, broker-owned Southern California commercial real estate firm that provides strategic property solutions tailored to clients’ needs. Throughout its 40+ year history, the firm has developed, managed and acquired more than 64 million square feet and completed more than $44.8 billion in brokerage transactions encompassing more than 43,000 brokerage deals. Voit’s unmatched expertise in Southern California brokerage, investment advisory, financial analysis, and market research enable the firm to provide clients with forward looking strategies that create value for a wide range of assets and portfolios. Further information is available at www.voitco.com.

VOIT REAL ESTATE SERVICES DIRECTS SALE OF 136,806 SQUARE-FOOT MULTI-TENANT INDUSTRIAL/FLEX BUSINESS PARK IN INLAND EMPIRE

/by Denisse

RANCHO CUCAMONGA, CA, (September 9, 2016) – Voit Real Estate Services has successfully completed the sale of Arrow Business Park, a seven-building, 136,806 square-foot multi-tenant industrial/flex business park in Rancho Cucamonga.

Frank Geraci and Juan Gutierrez of Voit’s Inland Empire office and Mike Bouma of Voit’s Orange County office worked together to represent both the buyer, Focus Real Estate, and the seller, Essex Arrow LLC, in the transaction.

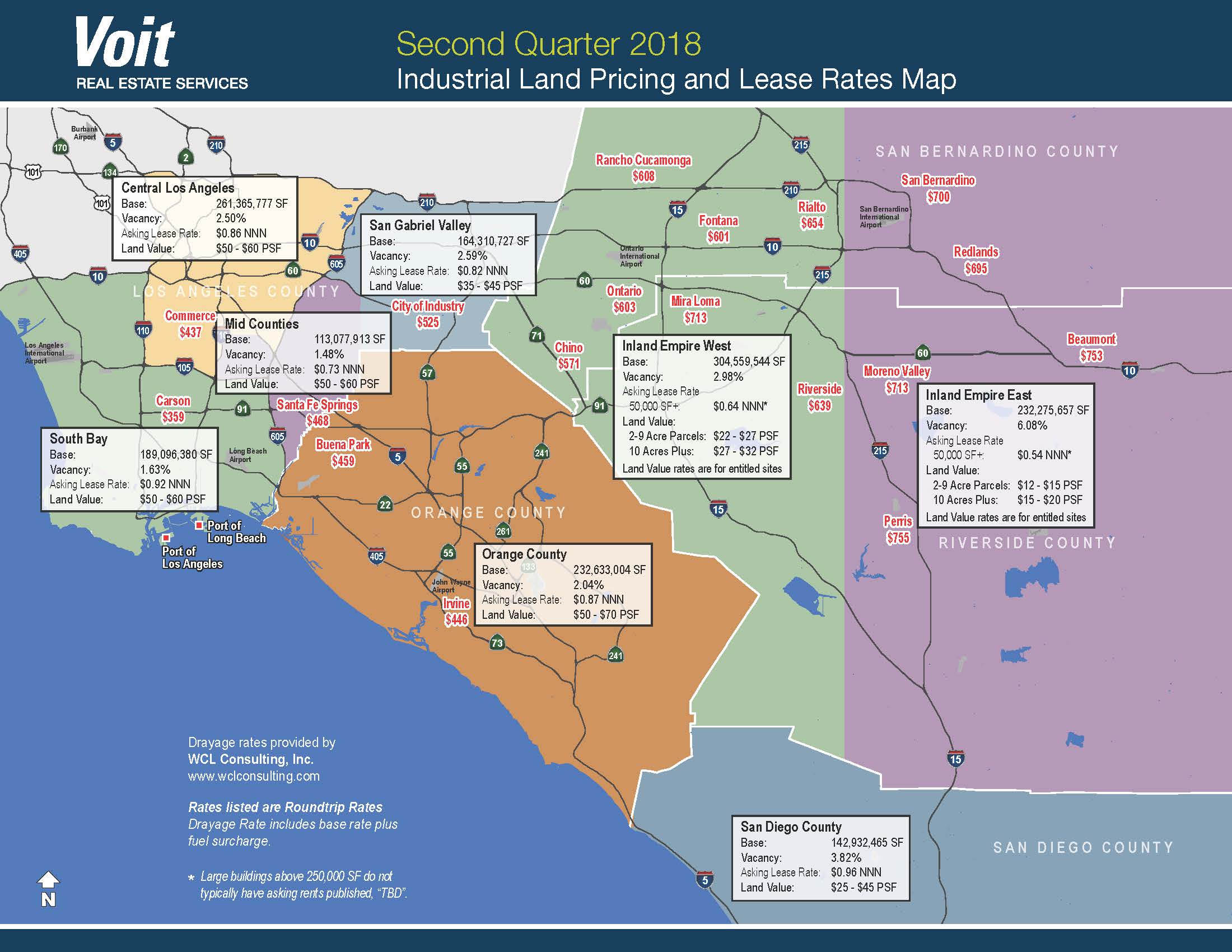

“The Inland Empire is one of the strongest industrial markets in the nation,” comments Geraci. “Vacancy rates in the prime Inland Empire West submarket finished the second quarter at 3.75 percent, and average lease rates jumped to $0.56 per square-foot, surpassing pre-recession peak rental rates for the first time ever. Based on these strong market fundamentals, the Arrow Business Park is extremely well-positioned to capitalize on rising rental rates and the growing demand for quality industrial space throughout the region.”

The business park, which was sold for $15.4 million, consists of 69 units ranging from 240 to 12,650 square feet in size.

Geraci explains that no new multi-tenant industrial business parks have been built in the last 15 years in the local market, adding that high land and construction costs have significantly limited the available supply of new multi-tenant industrial product in this region.

“Demand for space in existing multi-tenant parks is at an all-time high, placing upward pressure on lease rates for this product type,” Geraci adds. “In particular, demand for smaller flex units with office build-outs is on the rise as tenants continue to seek spaces that can accommodate a vast array of corporate functions. We are now at a point in the recovery cycle where multi-tenant industrial is poised for tremendous growth, and investors are taking note.”

Located in the Rancho Cucamonga submarket, which boasts a 1.76 percent industrial vacancy, the Arrow Business Park was 76 percent occupied at acquisition, presenting an initial challenge that the Voit team was able to overcome.

“Despite the property’s prime location in a highly desirable submarket, the vacancy rate raised initial concerns among some of the prospective buyers,” says Geraci. “We knew that the property presented tremendous opportunity for value creation in the hands of an experienced owner-operator. By emphasizing the strength of the market, the well-below replacement cost value, and the asset’s tremendous value-add potential, we were able to successfully secure a buyer that recognized the opportunity for value creation.”

Voit’s Inland Empire and Orange County offices worked together to achieve this success – an integration that is reflective of Voit’s new broker-owned platform in action, according to Geraci.

“Voit’s new structure gives every broker a personal stake in the company,” he explains. “The knowledge that the company’s success equates directly to each broker’s success has created a renewed energy and drive that is fueling collective work among and between our brokers. As a result, we’re able to create even better outcomes for our clients, and for ourselves.”

Geraci notes that in this case, the result was identifying a buyer that understood the property’s potential, and demonstrated surety of close.

“Focus Real Estate’s proven track record and solid financial backing enabled them to emerge as the right buyer for this asset,” he states.

Focus Real Estate acquired the property in partnership with HG Capital. Chris Bramel and Randy Bramel of Bridgeport Investments arranged the debt and assisted with the equity for the acquisition. An acquisition loan was provided by Silvergate Bank of La Jolla.

Built in 1988, the Arrow Business Park features ample parking, 16’ to 24’ warehouse clearance ceilings, ground level loading, and a 35 percent office build-out. Located at 9047-9087 Arrow Route in Rancho Cucamonga, California, the property offers immediate access to the I-210, I-15, and I-10 for distribution and transportation.

The property’s close proximity to residential communities and extensive retail amenities such as Victoria Gardens and many local service providers make this a strong, centrally-located industrial asset that will deliver long-term value to tenants and investors, according to Geraci.

Focus Real Estate plans to upgrade the property, reposition the vacant space through a series of capital improvements, lease the vacant space, and bring rents to market upon tenant rollover in order to deliver strong risk-adjusted returns to its investors.

About Voit Real Estate Services

Voit Real Estate Services is a privately held, broker-owned Southern California commercial real estate firm that provides strategic property solutions tailored to clients’ needs. Throughout its 40+ year history, the firm has developed, managed and acquired more than 64 million square feet and completed more than $42.5 billion in brokerage transactions encompassing more than 41,000 brokerage deals. Voit’s unmatched expertise in Southern California brokerage, investment advisory, financial analysis, and market research enable the firm to provide clients with forward looking strategies that create value for a wide range of assets and portfolios. Further information is available at www.voitco.com.

Mike Bouma, SIOR

Senior Vice President

(714) 935.2340

[email protected]

LIC# 01070753

Paul Caputo, MBA

Senior Vice President

(714) 935.2332

[email protected]

LIC# 01196935

Sebastian Lozano

Associate

(714) 935.2303

[email protected]

LIC# 02143474