12472 Edison Way: King Shocks taking over Isuzu’s Garden Grove Facility

/by Denisse

By Mark Mueller | June 6, 2016

Garden Grove HQ

King Shocks, a Garden Grove-based maker of shock absorbers and other automotive products, has bought an industrial property in its hometown for a new, larger headquarters.

The company recently closed on the purchase of 12472 Edison Way, a 55,576-square-foot industrial facility about half a mile north of the Garden Grove (22) Freeway near Lampson Avenue.

An affiliate of Irvine-based LBA Realty sold the building for a little more than $9.4 million, or $170 per square foot. LBA acquired the property in 2012 as part of a reported $144 million portfolio deal of local industrial properties previously owned by Kilroy Realty.

The latest sale was brokered by Voit Real Estate’s Mike Bouma, Paul Caputo and Eric Smith.

The property previously served as an Isuzu Motor Co. research and development facility, housing offices, a fuel storage room, and a car wash for the automotive company.

The facilities should fit well for King Shocks, a manufacturer and servicer of custom-made automotive shock absorbers, as well as performance racing products for utility vehicles and professional racing.

“There is around a 2% vacancy rate in the area and it took almost a year to find the right building for this group,” Voit’s Caputo said in a statement.

How Much Runway Is Left in Orange County?

/by Denisse

ORANGE COUNTY, CA—Experts in the commercial real estate industry have been warning of an imminent end to the upward cycle we’ve been experiencing since the recession and the beginning of the recovery. Opinions on just how soon it will end vary according to the market and different sectors within that market. GlobeSt.com spoke exclusively with two of Voit Real Estate Services’ Orange County-based brokers, Doug Killlian, SVP in the Irvine office, who specializes in the office market; and Mike Bouma, SVP in the Anaheim office, who specializes in industrial, to find out where this market stands in their respective sector specialties.

GlobeSt.com: How much runway do you think is left in the current commercial real estate up-cycle in your geographical market?

Killian: There are cycles in real estate that can be identified as recovery, expansion, spec development, then recession. We are definitely well into the expansion phase, in which businesses are optimistic about the future and are adding employees. The market supply begins to thin, and speculative development commences again. We are now experiencing that dynamic, and we will continue to post positive absorption well through 2016.

Bouma: I feel confident we should see continued appreciation in the Orange County industrial market for another two to three years. It is hard to predict further out, but barring any unforeseen events that could affect the national and/or global economy, I’m hopeful to see steady, yet slower, growth for the years following.

GlobeSt.com: When the cycle eventually slows again in your market, do you anticipate it to be a gradual slowdown or something more dramatic?

Killian: Recessions are not ideal, but inevitable. However, our market will be somewhat shielded from the full force, and it will be gradual. One large factor to that statement is we will not be overbuilt with large amounts of product never being occupied, and we will have a much more diversified tenant base than ever before.

Bouma: I don’t see any apparent bubbles forming in the industrial market in Orange County where we would be in for a significant downturn in the market, nor a shift in the supply curve that would result in a glut of product coming on the market, which would lead to a dramatic decline in prices or lease rates. We have a more diversified economy in Orange County this time around that is not likely to suffer from the impact of a downturn in a specific industry type, such as the mortgage-industry implosion and debt crisis that preceded the last recession and had a large impact on Orange County—or like the significant drop in oil prices is having on markets across the nation that are heavily reliant on one industry. Interest rates are also on everyone’s mind, but with the uncertainty in the national and global economies, and with inflation fears not materializing, I’m hopeful the Fed will do what they can to prevent a rapid spike in interest rates, which could have a negative effect on values if increased too quickly.

GlobeSt.com: What are the fundamentals in your market that give it strength when a down cycle hits?

Killian: Quality of life, demographics, diversified work force and lack of available land to overdevelop. Secondly, we have a large amount of local and offshore money just waiting on the sidelines to buy up Orange County real estate.

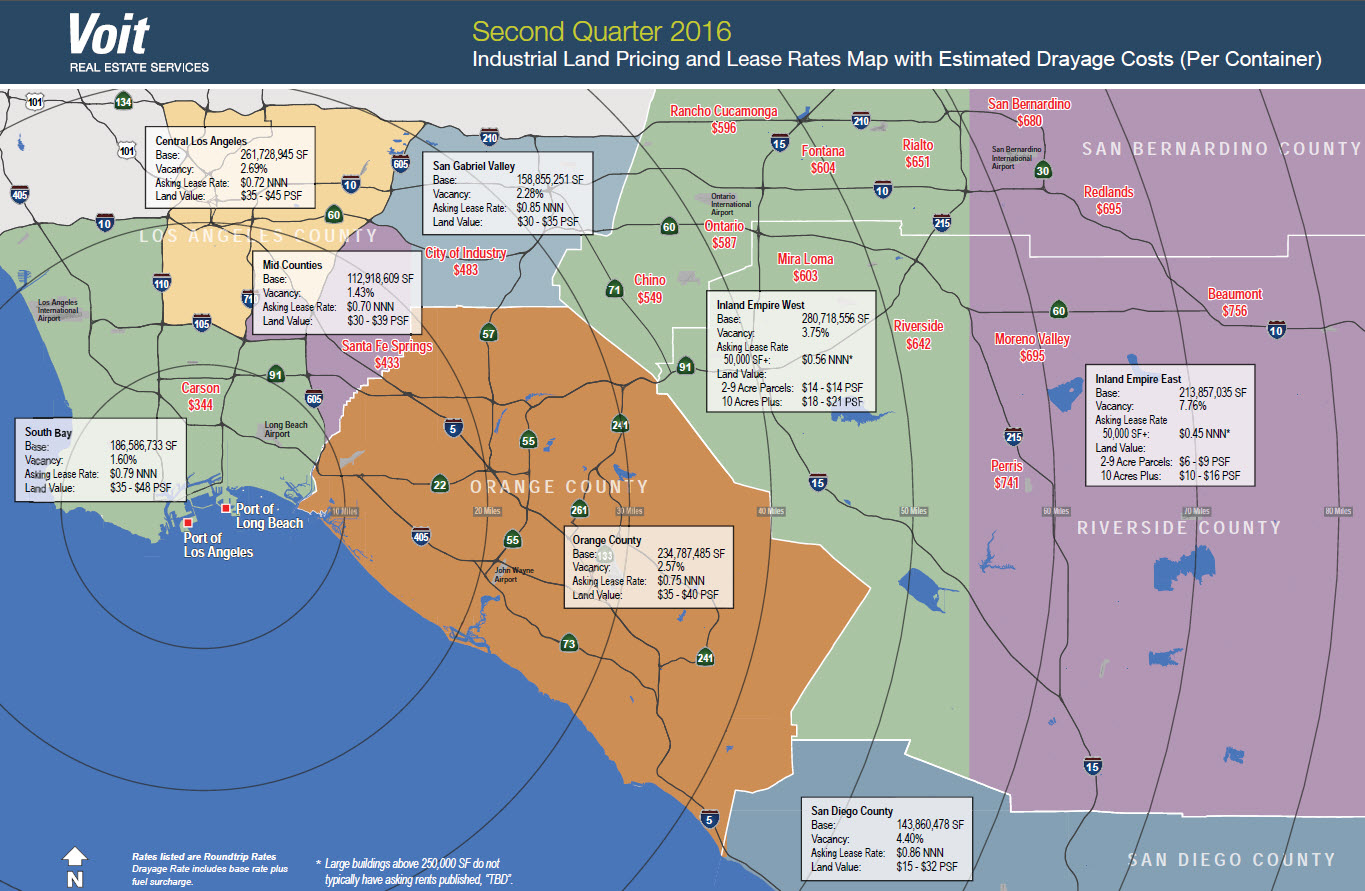

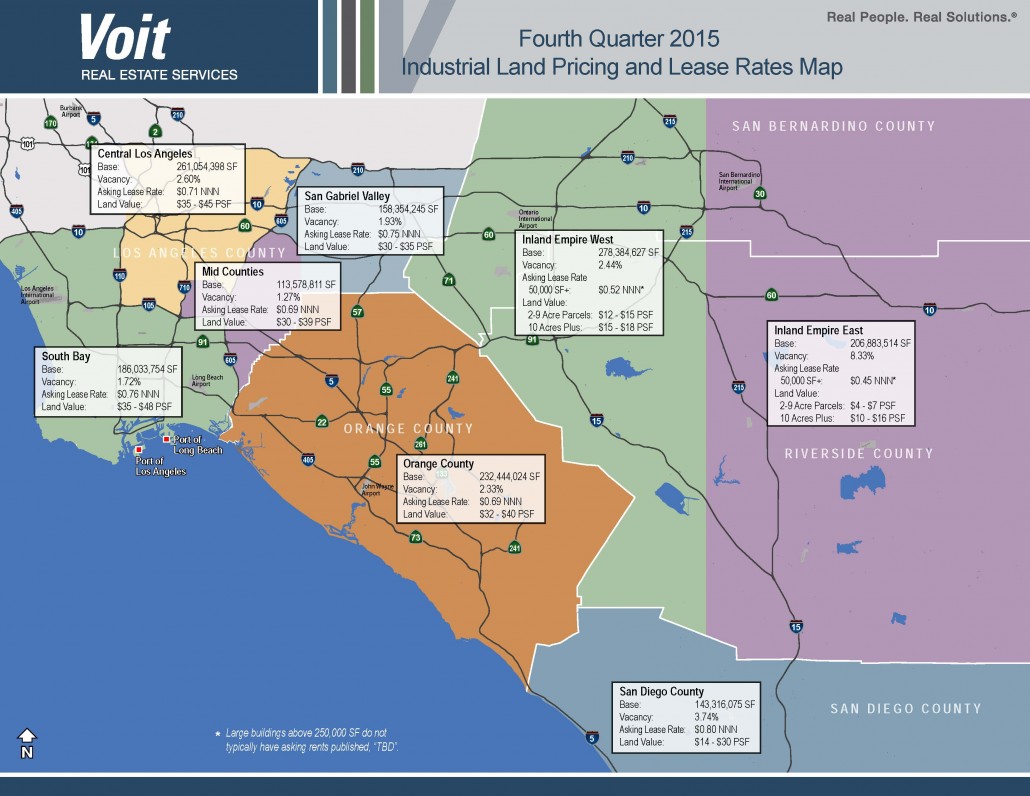

Bouma: During the prior six years leading up to the recession, there was over 7 million square feet of new industrial product delivered in Orange County. As a comparison, there has been only 2.7 million square feet of new product delivered in the six years from 2009 to present. The Orange County industrial market ended 2015 at a 2.33% vacancy factor—the lowest ever recorded despite 2.2 million square feet of new deliveries since 2014. We have a scarcity of land to build new product, and cities such as Anaheim, Irvine, Costa Mesa, and Huntington Beach are allowing the rezoning of portions of their aging industrial markets to allow for high-density residential projects, further reducing the industrial base. These factors, combined with higher construction costs, create huge barriers-to-entry in our market.

What this means is that even if there is a downturn in demand, it is very unlikely we are going to see a related shift in supply. We have a nice buffer from where we are at now before we will see high vacancy factors leading to downward rents and property values. During the last recession, even with the debt crisis and worry that the industrial market was going to follow suit of the residential market with a flood of REOs, we saw a comparative dribble in the industrial market as lenders negotiated workouts and extensions with many commercial borrowers. We are now selling those properties at or greater-than-pre-recession pricing. All the while, businesses weathered the storm by cutting costs in other ways, strengthening their balance sheets, gaining efficiencies, relying less on bank financing for growth and lowering their lines of credit and maintaining lower loan-to-value ratios on their properties. I think the industrial market in Orange County is generally very healthy, and the businesses within it are as well. All these factors contribute to the strength and resilience of our market.

GlobeSt.com: What else should our readers know about your market weathering cycles?

Killian: Occupancy is everything. Treating your tenants as customers will pay off in the long term; they are the key to weathering the down cycle.

Bouma: We all know that as much as Orange County is an expensive area to do business, it continues to be a great place to live and work. Local-owned businesses don’t want to make a move to lower-priced cities or states, even if it makes economic sense to do so. Proximity to where business owners live is always going to have a factor in keeping industrial businesses solidly anchored in Orange County. Great schools and universities for their families, availability of skilled labor and proximity to the ports are among the reasons that keep industrial-related businesses in Orange County. Although we have seen many of the large manufacturing businesses leave the state or country over the years in order to compete to survive, many companies still retain their headquarters in Orange County, while outsourcing to a manufacturing facility overseas or larger distribution center in areas such as the Inland Empire.

Ben Franklin – Cargo Ships are Increasing in Size

/by Charlene BlancoThe largest container ship to ever make port in North America, center, unloads its cargo in the Port of Los Angeles in San Pedro, CA on Saturday, December 26, 2015. After making its maiden voyage from China, where it was built, the CMA CGM Benjamin Franklin arrived before dawn with its cargo. Read more

The Big Squeeze – Feeling the Pressure of Low Inventory

/by Charlene BlancoThey call New York City the Big Apple and New Orleans the Big Easy. When it comes to the industrial property market, Orange County is becoming known as the Big Squeeze. Conditions are such that good value is getting harder to find, competition for space is becoming intense and prices are being forced up by the simple law of supply and demand. Vacancy is now so low, (2.6% at the end of September) that some businesses are forced to stay where they are because a better option is just not available. The result: lower transaction volume and even fewer properties to choose from. Measured in square feet, sale transaction volume in Q3 of 2015 was 47% lower than it was the same time last year. Even leasing activity is feeling the pressure, having dropped by 67% in the same period. Read more

VOIT REAL ESTATE SERVICES DIRECTS THE $10,528,000 SALE OF A 66,000 SQUARE-FOOT INDUSTRIAL BUILDING PROPERTY IN GARDEN GROVE, CA

/by Denisse

Garden Grove, CA (November 1, 2015) – Mike Bouma, Senior Vice President and Paul Caputo, Vice President, of Voit Real Estate Services’ Anaheim office successfully directed the $10,528,000 million sale of a 66,000 square-foot industrial warehouse in Garden Grove, on behalf of the buyer, The Smith Family Trust. The buyer, a distributor of educational products, will use this property to expand and consolidate the operations of their business, Teacher Created Resources, according to Bouma. The brokerage team successfully executed a plan where they were able to locate a new facility on behalf of the buyer, after which they listed and sold their two existing building and successfully executed a complex multi-property exchange. The brokerage team also coordinated a team of professionals to assist with the transaction and relocation, including the space planner/architect, racking consultant, and exchange accommodator.

The property is located at 12621 Western Avenue in Garden Grove, CA within the West Orange County Industrial market place.

About Voit Real Estate Services

Voit Real Estate Services is an 11 office commercial real estate firm that, through its brokerage and real estate management professionals working together, provides strategic property solutions tailored to clients’ needs. Combining more than 40 years of expertise in brokerage, investment advisory, financial analysis, market research, real estate management and tenant advisory, Voit provides clients with forward looking strategies that create value for their assets and portfolios.

Voit is a privately held, debt-free firm that has successfully navigated numerous market cycles since 1971 and currently employs more than 250 people. Voit has owned, developed and managed over 64 million square feet of commercial real estate, participated in $1.4 billion of construction projects and completed over $42.5 billion in brokerage transaction volume. Further information is available at www.voitco.com.

VOIT REAL ESTATE SERVICES DIRECTS THE $6,052,284 SALE OF A 41,454 SQUARE-FOOT INDUSTRIAL BUILDING IN HUNTINGTON BEACH

/by Denisse

Huntington Beach, CA (September 23, 2015) – Mike Bouma, Senior Vice President and Paul Caputo, Vice President of Voit Real Estate Services’ Anaheim office successfully directed the $6,052,284 million sale of a 41,454 square-foot industrial warehouse in Huntington Beach, on behalf of the Seller, a real estate partnership. The buyer, a distributor of educational supplies, will use this property for warehousing, distribution, light manufacturing and administrative office use, according to Mike Bouma and Paul Caputo.

“This is a record sale price for a second generation building in the area. It’s also an indication of where prices are headed with the lack of available buildings, high demand to purchase and continued low interest rates,” according to Mr. Caputo.

The property is located at 5422 Argosy Avenue in the desirable North Huntington Beach area. The property is adjacent to Corporate neighbors such as Boeing, Quicksilver, Cambro Mfg., C&D Aerospace, and Cleveland Golf.

About Voit Real Estate Services

Voit Real Estate Services is an 11 office commercial real estate firm that, through its brokerage and real estate management professionals working together, provides strategic property solutions tailored to clients’ needs. Combining more than 40 years of expertise in brokerage, investment advisory, financial analysis, market research, real estate management and tenant advisory, Voit provides clients with forward looking strategies that create value for their assets and portfolios.

Voit is a privately held, debt-free firm that has successfully navigated numerous market cycles since 1971 and currently employs more than 250 people. Voit has owned, developed and managed over 64 million square feet of commercial real estate, participated in $1.4 billion of construction projects and completed over $42.5 billion in brokerage transaction volume. Further information is available at www.voitco.com.

Mike Bouma, SIOR

Senior Vice President

(714) 935.2340

[email protected]

LIC# 01070753

Paul Caputo, MBA

Senior Vice President

(714) 935.2332

[email protected]

LIC# 01196935

Sebastian Lozano

Associate

(714) 935.2303

[email protected]

LIC# 02143474